Counterfeiting: A Major Issue with Drastic Consequences

Last week, the FDA posted an article highlighting the risk of unapproved weight loss drugs, including semgalutide and tirzepatide. These drugs pose a major risk to patients due to their lack of quality assurance.

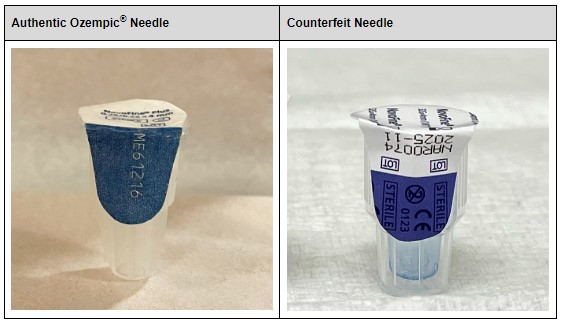

Illegally marketed versions of these drugs have infiltrated pharmaceutical supply chains, most notably, Ozempic. Counterfeit versions of the drug have been marketed as authentic, but could contain too much, too little, no active ingredient, or harmful ingredients. These illegal drugs pose a risk to consumers; in fact, according to a report last year, 2 people died and three people were hospitalized after consuming counterfeit Ozempic.

Another DSCSA Delay

The FDA announced last week that they were delaying implementation of Enhanced Drug Distribution Security requirements, along with other requirements of section 582(g) of the Drug Supply Chain Security Act. This compliance extension would only be for trading partners who have made a documented attempt to complete data connections with immediate trading partners, or those who are already doing so.

The FDA has emphasized the decision came from a concern over potential drug supply shortages. In the release, the FDA referenced trading partners’ struggles “resolving issues involving missing or erroneous data in electronic DSCSA transaction information and transaction statements” without delaying product distribution (including those in shortage) downstream.

The concern for preventing supply shortages downstream is real. Preventing shortages can help minimize the risk of counterfeit products, given how shortages lead to higher rates of counterfeits as consumers are willing to pay higher prices for goods. However, what’s also important to consider is the reason behind creating Enhanced Drug Distribution Security (EDDS) requirements in the first place.

Counterfeit Crisis: DSCSA’s Role

The Enhanced Drug Distribution Security requirements under the DSCSA were created for instances like this. Counterfeiters have become increasingly deceitful in their craft: packages with authentic lot numbers and detailed inventory trails make it very difficult to determine the legitimacy of drugs. Sight alone is simply not enough to authenticate legitimate drugs from counterfeits, especially for end consumers—just look at the image above!

Enhanced Drug Distribution Security requirements drastically reduce this risk, mandating product-level traceability and interoperability. Flagging down counterfeit Ozempic is much easier to do with EDDS requirements in place; the FDA delaying these requirements again could pose risks similar to what we’ve seen with Ozempic.

While it’s essential to acknowledge the FDA’s commitment to preventing drug shortages, delaying EDDS requirements may bring about its own consequences.