An FDA-Approved Plan with Major Implications

Earlier this year, the FDA authorized Florida’s proposal to import select drugs from Canada under section 804 of the FD&C Act. The law allows companies to import prescription drugs in bulk if doing so saves Americans money and doesn’t put the health and safety of Americans at risk.

According to the office of Florida Governor Ron DeSantis, the proposal will save the state an estimated $180 million annually. More specifically, this program will reduce the price the state pays for medications used by certain groups, including older populations, foster children, and incarcerated individuals. Florida will begin with importing small cases of chronic medication, including those treating HIV/AIDS, mental illness, prostate cancer, and urea cycle disorder.

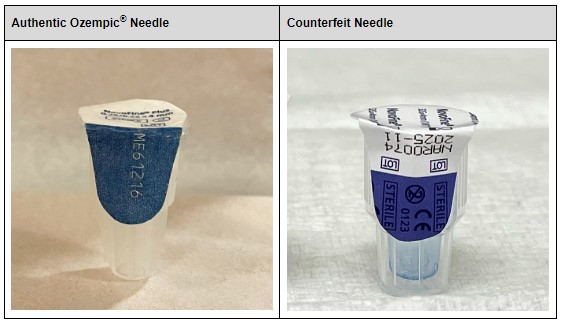

The FDA has emphasized that for Canadian drugs to be imported into the US, Canadian partners and American companies receiving them must adhere to additional security requirements. These include specifying the drugs they plan on importing, verifying drug authenticity and compliance with FDA-approved specifications, and relabeling these drugs in accordance with FDA policy.

Not Everyone Sees the Potential Benefits

However, despite the cost-saving claims from Florida as well as the FDA’s approval of the change, many question the decision and the proposed benefits. Many experts believe this policy change will not solve the high-price issue of prescription drugs in the US. Critics argue the Canadian drug supply is too small, which means the change will not only have a minor impact on price reduction in the US, but could lead to major shortages throughout Canada. Four days after the policy change, the Canadian Government released the following statement:

“The Government of Canada is taking all necessary action to safeguard the drug supply and ensure Canadians have access to the prescription drugs they need and has been clear in its position: bulk importation will not provide an effective solution to the problem of high drug prices in the US.”

Accordingly, prominent members within the pharmaceutical industry have counteracted against the ruling; Stephen Ubl, President and CEO of Pharmaceutical Research and Manufacturers of America (PhRMA), believes the ruling has detrimental implications on American pharmaceutical supply chains. “The importation of unapproved medicines, whether from Canada or elsewhere in the world, poses a serious danger to public health,” Ubl claimed following the approval.

What Does this Mean for Compliance?

As to how these Canadian imports will comply with DSCSA Requirements, in particular Enhanced Drug Distribution Requirements, remains questionable. With Enhanced Drug Distribution Requirements delayed for connected trading partners in the US, will Canadian pharmaceutical manufacturers be expected to fully comply with DSCSA in November or will they be eligible for additional time for completion?

Is anyone aware of any Canadian pharmaceutical importation plans or activity since the policy change took effect in early January 2024? Have Floridians spent $50 million implementing the plan? If yes, how did that ‘investment’ benefit American patients? Since more states may adopt a similar policy in the future, understanding fiscal costs and benefits is essential.

Finally, though Canadian imports must meet additional drug security requirements, will counterfeiters see this policy change as a money-making opportunity? Considering the numerous instances of domestic counterfeiting, we can’t count this out as a possibility.